after tax income calculator iowa

Your average tax rate is. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Lottery Calculator The Turbotax Blog

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

. The top marginal rate of 98 will remain in place until 2022. Figure out your filing status work out your adjusted gross income Net income. That means that your net pay will be 43543 per year or 3629 per month.

It can also be used to help fill steps 3. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The following steps allow you to calculate your salary after tax in Iowa after deducting Medicare Social Security Federal Income Tax and Iowa State Income tax.

Tax March 2 2022 arnold. You can alter the salary example to illustrate a different filing status or show. The above calculator assumes you are not married and you have no dependants so the standard.

Calculate your net income after taxes in Iowa. The Federal or IRS Taxes Are Listed. Iowa Income Tax Calculator 2021 If you make 62000 a year living in the region of Iowa USA you will be taxed 11734.

Your average tax rate is 217 and your marginal tax rate is 360. You can alter the salary example to illustrate a different filing status or show. The Iowa Income Taxes Estimator.

After Tax Income Calculator Iowa. Corporations in Iowa pay four different rates of income tax. Tax March 2 2022 arnold.

The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. United States Italy France Spain United Kingdom Poland Czech Republic Hungary. After Tax Income Calculator Iowa.

After Tax Income Calculator Iowa. Just enter the wages tax withholdings and other information required. The federal income tax has seven tax brackets which range from 10 to 37.

For instance an increase of. The Lottery Tax Calculator- calculates the tax and lump sum payment after lotto or lottery winnings. Optional Choose Normal View.

15 Tax Calculators. However the rates will be gradually reduced to meet the revenue. Compound Interest Calculator Present.

Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457. After Tax Income Calculator Iowa.

Calculate your Iowa net pay or take home pay by entering your per-period or. Your average tax rate is 1069 and your marginal tax rate is.

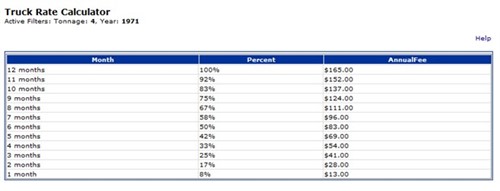

Calculate Your Transfer Fee Credit Iowa Tax And Tags

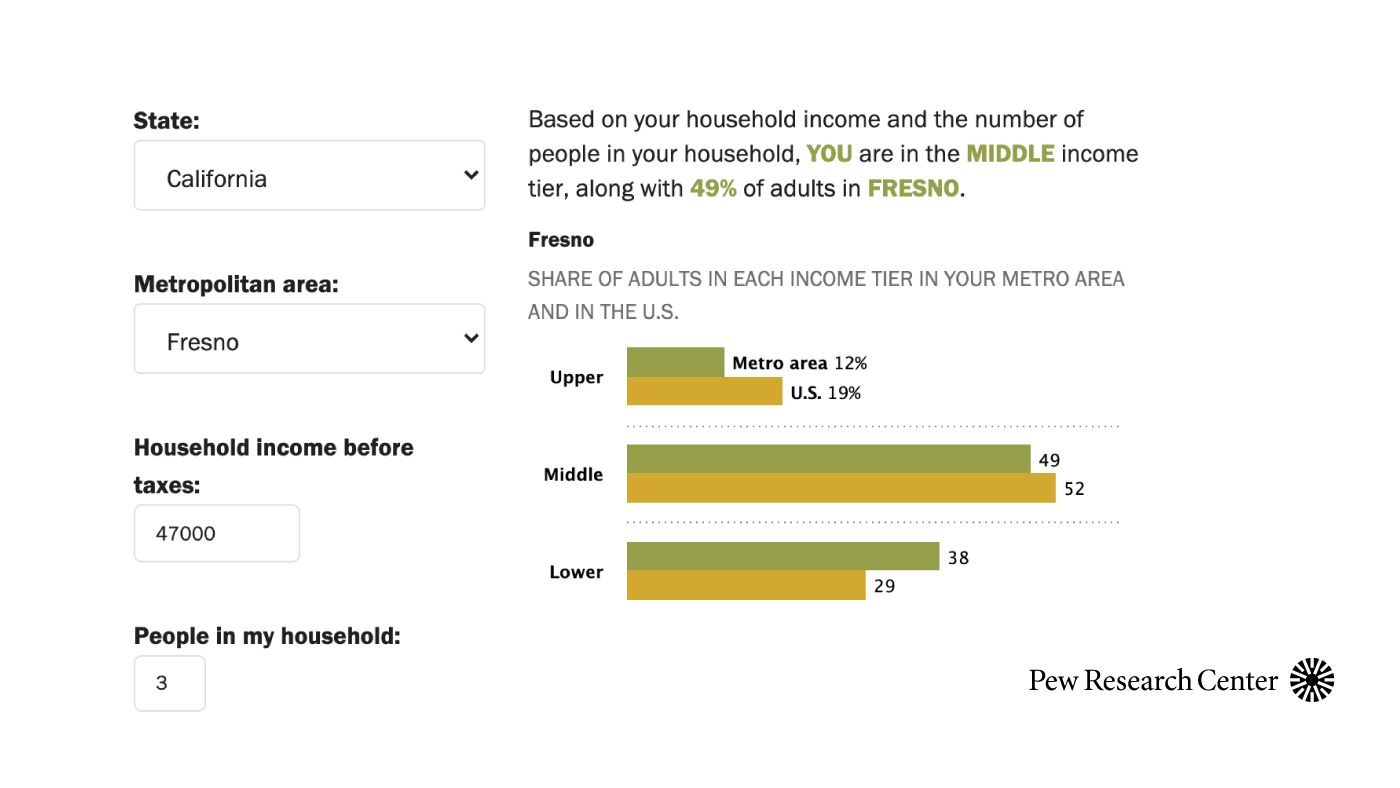

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

United States Us Salary After Tax Calculator

Iowa Lawmakers Working To Eliminate State Taxes On Retirement Income

2022 Iowa Farm Income Tax Webinar

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Income Tax Calculator Estimate Your Taxes Forbes Advisor

Calculate Your Transfer Fee Credit Iowa Tax And Tags

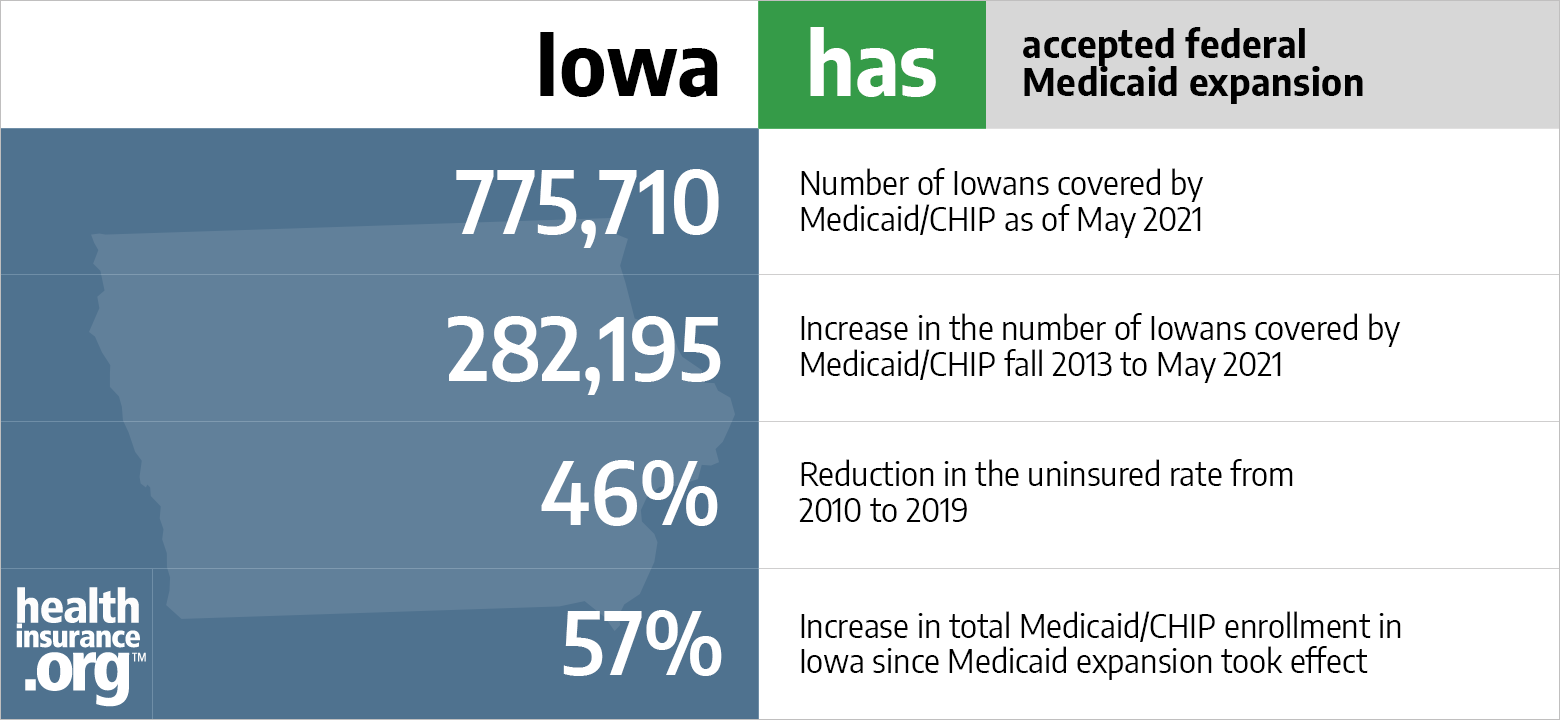

Aca Medicaid Enrollment In Iowa Updated 2022 Guide Healthinsurance Org

Where S My Refund Iowa H R Block

Iowa Salary Paycheck Calculator Gusto

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Those Crazy Iowa Property Taxes Home Sweet Des Moines

Iowa Salary Calculator 2022 Icalculator