estate income tax return due date 2021

California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. Wisconsin 2022 Form 5S Instructions.

State Income Tax Rates And Brackets 2021 Tax Foundation

Due date of return.

. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension. 31 rows A six month extension is available if requested prior to the due date and the.

The filing extension must be requested on or before the statutory nine-month due date. Any tax that remains unpaid after the unextended due date of the tax return continues to be subject to 18. Due date of return.

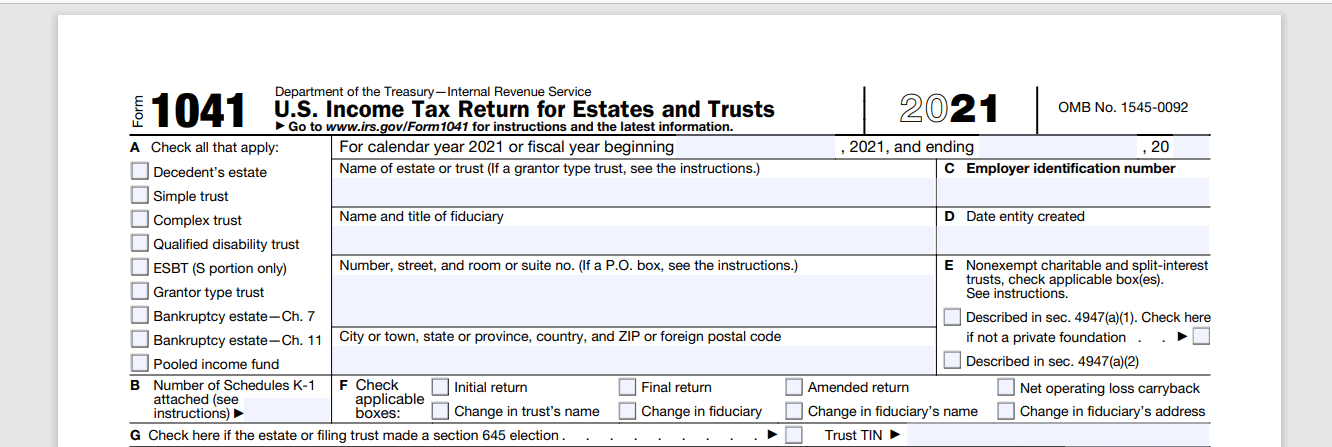

IT-2664 Fill-in 2022 IT-2664-I Instructions Nonresident Cooperative Unit Estimated Income Tax Payment Form - valid for sales or transfers date of conveyance after December 31 2021. Calendar year estates and trusts must file Form 1041 by April 18 2022. The income deductions gains losses etc.

IR-2022-175 October 7 2022 WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by. File an amended return for the estate or trust. 13 rows Only about one in twelve estate income tax returns are due on April 15.

The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year. If the section 645 election hasnt been made by the time the QRTs first income tax return would. Due on or before April 19 2022 2021 Form 2.

The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report. Income Tax Return for. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041 Accessed Dec.

After that date unclaimed 2021 refunds become the property of the Department of the Treasury. A Wisconsin fiduciary income tax return Form 2 for an estate for 2021 is due on or before. Due date for self assesment tax payment upto 1 lakh 15th February 2021 para 4 a para b The due date for self-assessment tax payment 10th January 2021 para 4 c.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The Estate Tax is a tax on your right to transfer property at your death. Deadline for filing a 2021 calendar-year C corporation or calendar-year estatestrusts tax return.

Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for. The official tax deadline set for filing your federal income tax return each year is April 15 but it can be flexible. This 2021 is Thursday but the deadline can sometimes be.

Personal income tax extensions must be filed on or before April. Of the estate or trust. Register for Self Assessment if youre self-employed or a sole trader not self-employed or registering a partner or partnership.

The income that is. A final individual income tax return Form 1 or 1NPR for calendar year 2021 is due April 18 2022. Tax Bulletin 214 July 2021 page 8.

10 rows Estate Tax Return for decedents dying after December 31 2020 and before January 1 2022. Fiduciary Income Tax Return. Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 were eligible for an 850 direct relief payment this year.

Nri Tax Filing Deadline For Fy 19 20 Updated To 31st May 2021 Sbnri

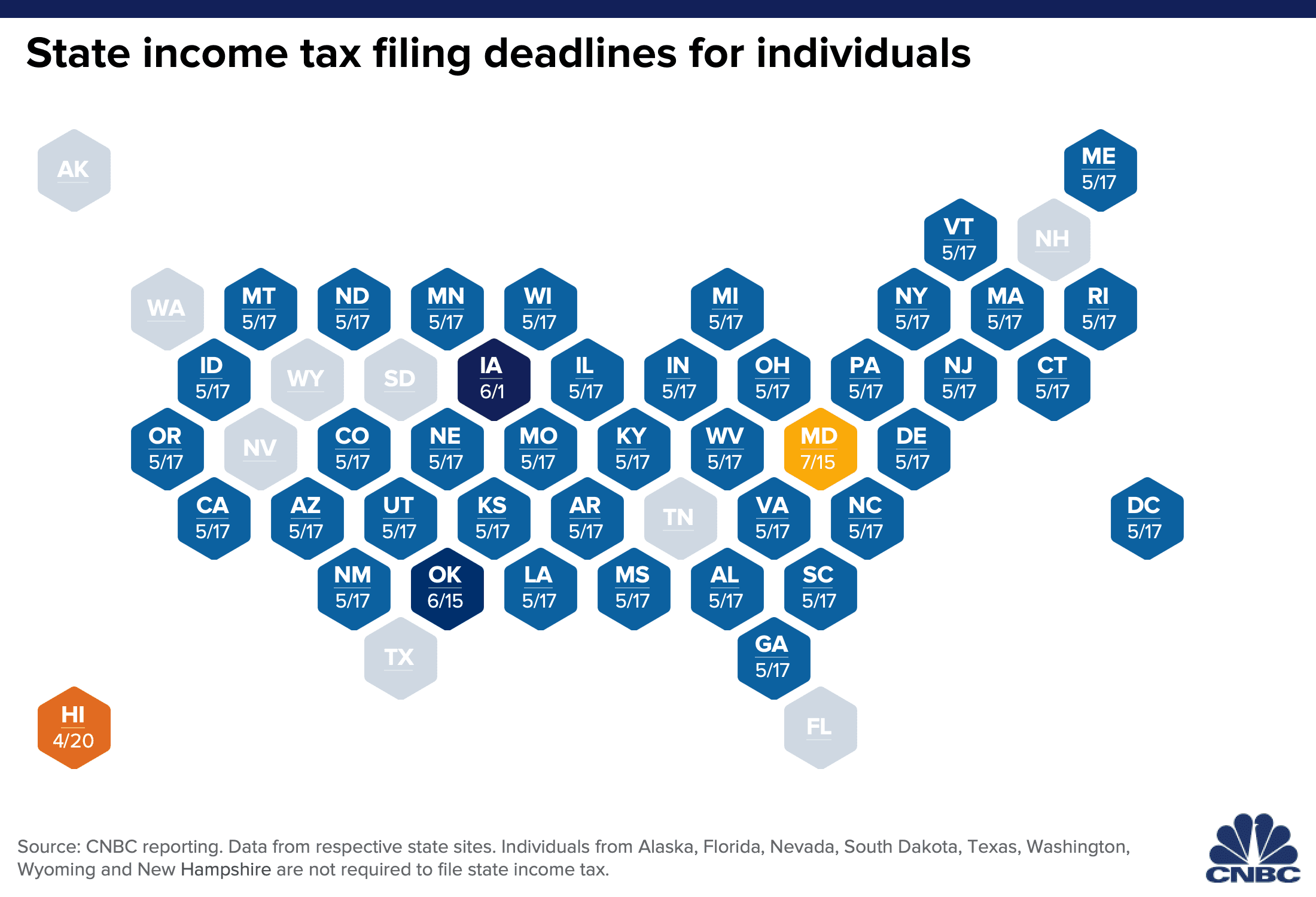

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

Federal Income Tax Deadline In 2022 Smartasset

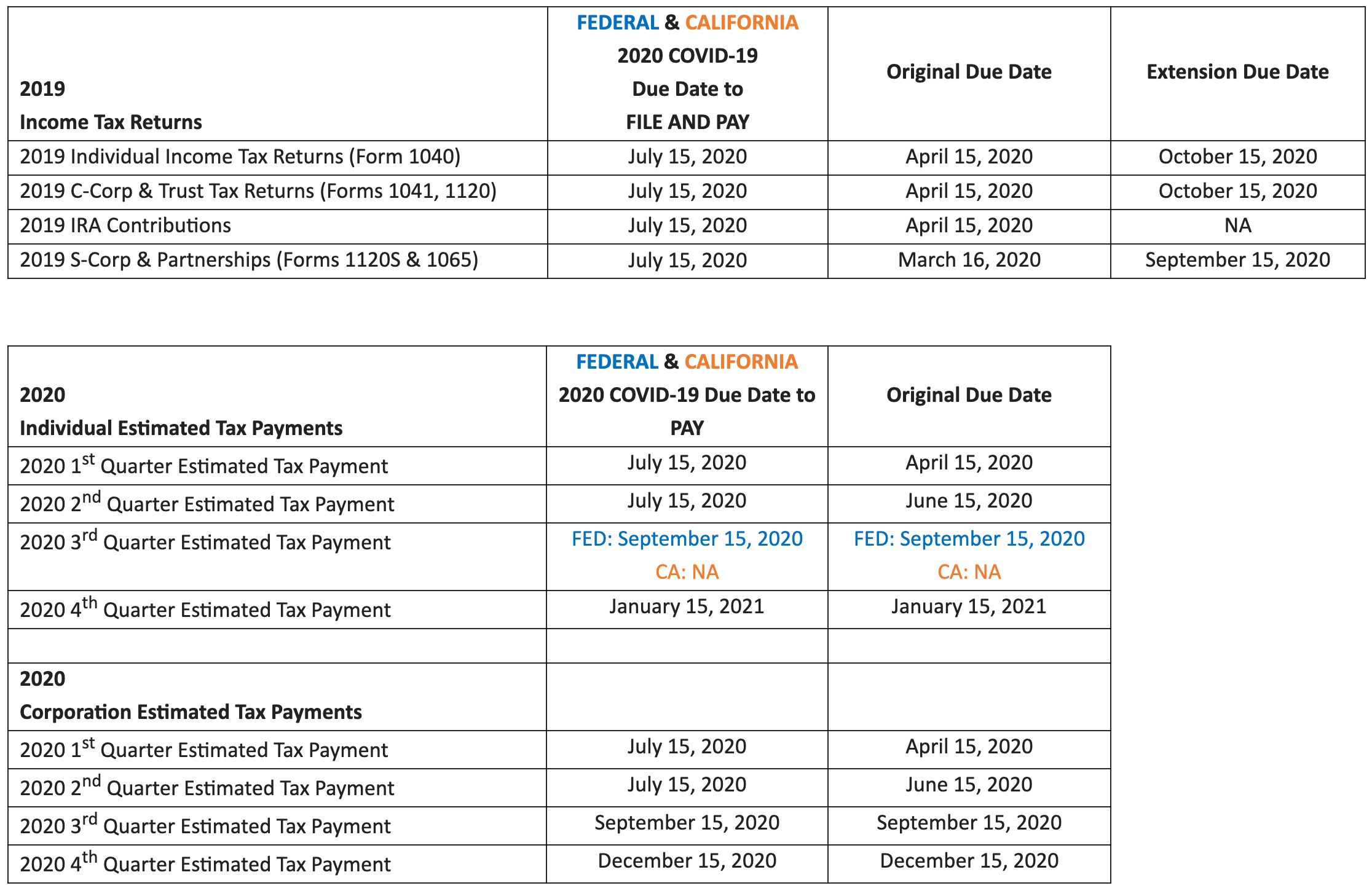

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

Complying With New Schedules K 2 And K 3

Tax Season Already Filing Deadlines In 2021 Seymour Perry Llc

Income Tax Department Of Finance And Administration

2021 Federal Tax Filing Deadlines 2022 Irs Tax Deadlines 1041 Due Date

Newsletter Timothy J Erasmi Esq Virtual Estate Attorney

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Death In The Family Turbotax Tax Tips Videos

How Many People Pay The Estate Tax Tax Policy Center

10 Tax Deadlines For April 18 Kiplinger

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)